If you’re a millennial or older, you most likely still remember the term “American Dream”. The phrase means many things to many different people, but what it essentially encompassed were four steps.

- Grow up and get a good job, either by climbing the ranks of a company or going to college and skipping the line.

- Find someone to marry.

- Buy a nice house with a white picket fence.

- Have a family and raise them to do the same.

While many of us (including me) graduated in the middle of the 2008 housing crisis, we were just too young to truly understand what was happening. A lot of us just saw cheap houses with insanely low interest rates of 0.5-2% and thought “No need to rush, I’ll get one in the future when I’m making more money”. Once we made more money, the houses would be super affordable, right?

Well, those of us who bought a home as teenagers or in our earlier 20s were the smart ones. The rest of us are screwed.

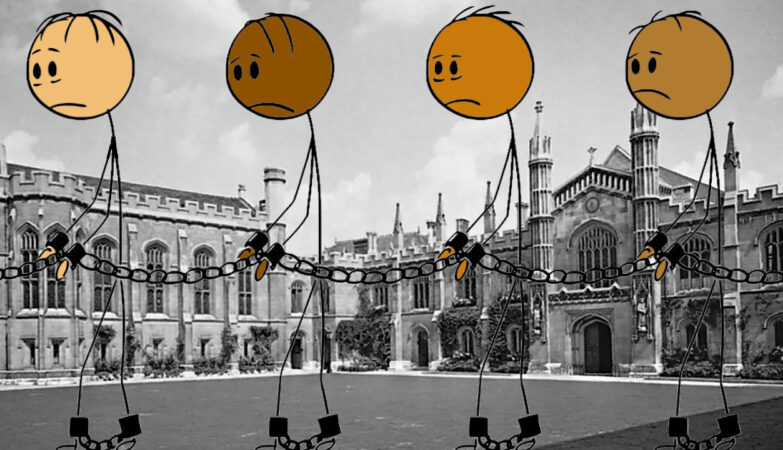

We’re doomed to spend 50% or more of our income on cheaper, poorly built, overpriced, cardboard cutouts in a neighborhood with an oppressive HOA, barely any land, increasingly skyrocketing taxes, and interest rates so high, we will die before the loans are ever paid off.

And that’s for couples with no kids. If you’re single or parents.. you better win the lottery.

If you’re single with kids.. you’ll be lucky if you can afford rent in a roach-infested apartment in the worst neighborhood in your city without government assistance, a sugar daddy (or mama), and an OnlyFans account.

After the Great Depression, America experienced an economic boom not seen anywhere else across the globe. The World War had depleted every other first and second world nation’s resources. Newly implemented socialist policies from President FDR had ignited a resurgence in non-wealthy Americans and with no one standing in its way, the USA became the leader in manufacturing worldwide.

Unfortunately, this boom didn’t last forever and slowly but surely, all four of these factors have slowly been eroded away due to societal change, poor policy decisions, recovering economies of other countries, and.. just plain old greed.

One of these most detrimental side effects has been the seemingly never ending housing crisis.

Recent data from April of 2025 showed that median home prices were at an unbelievable $419,200. Meanwhile, the median income per capita (per person) is only $45,000.

This means that the average home is almost ten times the yearly income of an average American citizen.

Compare this to 1973 when the median home price was only around $33,100. Even back then when the economy was beginning its downturn, the median income was around $5,400. Of course, that number included men and women. Men, specifically were making a little over $8k while most women couldn’t even hit $3k.

This is important because the gender income divide in the 70’s was significantly higher back then than it is now and men were the buyers of the vast majority of homes. Even taking the lowest number in to account, that means the average home was about six times the yearly income of a new buyer.

When we go back even further, housing affordability was significantly better, averaging out at only around three times yearly income.

So now that the rant and statistics part is over, let’s dive into the reasons why homes will likely never be affordable again, or at least in our lifetimes.

This goes for you too Gen Z.

Incomes Are Too Low

Some people think that full-time workers can afford housing, but that’s a myth. In some housing markets, only workers earning hourly wages of $30 or more can comfortably afford housing. In fact, there is no metro area in which full-time workers earning the Federal minimum wage can comfortably afford the costs of a typical 2-bedroom rental unit.

On average, a worker needs to earn $20.30 an hour to afford a typical 2-bedroom apartment. In other words, someone earning the federal minimum wage of $7.25 per hour would need to work almost three full-time jobs in order to afford a typical two-bedroom apartment.

And the problem is getting worse, not better. Incomes for low- and moderate-income workers have largely stagnated while housing costs have risen.

Demand for Affordable Housing Is Too Low

It’s not because they don’t want to, it’s because they can’t. The rents and home prices that many households can afford to pay are too low to cover the costs of developing and operating newly constructed housing. Some households’ incomes are too low to cover even the costs of maintaining and insuring existing housing.

In response, many contractors and builders just don’t want to invest in smaller homes because they don’t make enough money. Even with illegal immigrants powering the workforce who make quite a lot less than citizens, it still doesn’t churn enough of a profit compared to homes built for the wealthy which surprisingly, is actually growing in numbers due to the also growing divide of wealth in the nation.

Government Regulation Raises Costs

For example, limits on density restrict the number of homes that can be built on available land, and complicated and lengthy approvals processes can slow down the construction process and even cause developers to go elsewhere, making it difficult for the supply of housing to keep pace with increases in demand and rising housing prices throughout the entire housing market.

Zoning laws play their part as well. While it may seem like a good idea for local governments to designate certain areas of their cities or counties, it often results in extremely overpriced housing due to poor planning.

Having one area for residents, another for business, another for factories, and another for parks sounds organized and efficient until everyone from all over the nation starts flooding there in search of better life.

Limits on construction of middle- and high-end housing also affect affordability in the lower half of the housing market. Too little building for moderate- and high-income households hurts people further down the income spectrum, because moderate- and higher income households end up driving up rents on units that would otherwise be relatively affordable.

There are good reasons for many government regulations. But it’s also important to remember that increases in development costs are often passed on to families. We should at least take a hard look at regulations that affect development costs to figure out whether they are unavoidable and the benefits outweigh the costs, which can run to the tens of thousands of dollars per unit.

Reducing regulation will not lower costs enough to make new housing development for low-income households economical without government subsidies, but it could make housing more affordable for families in the middle.

Lack of Government Funding

To expand the availability of affordable homes, federal, state and local government fund a range of programs that successfully house millions of families. Unfortunately, these programs are not keeping pace with the need. Federal housing assistance over the past 15 years has been stagnant or declining at the same time that the number of renters with very low incomes (less than 50% of AMI) is increasing.

Currently, only about one in four eligible households with a housing burden receives government housing assistance of any kind.

Homes Became Investments

Thanks to private equity firms and folks like Stephen Schwarzman, the guy who basically started the entire idea, housing went from being just a place for people to live, to an asset for the investor class.

Brett Chistrophers at SageJournals actually wrote a really great in-depth article about Schwarzman’s takeover of the housing market.

To summarize it:

The United States in the mid- to late-1980s experienced a real-estate-centered financial crisis that in many respects was comparable with that which engulfed the country in 2007-2008.

Failed S&Ls were taken over by regulators, and in 1989, the government established the Resolution Trust Corporation (RTC) to dispose of their assets, which included repossessed properties as well as delinquent mortgages.

The key catalyst was a meeting between (Blackstone Group CEO) Stephen Schwarzman and a real-estate entrepreneur from Washington, D.C., called Joe Robert.

From among the assets being auctioned, Robert and Schwarzman set their eyes on a package of approximately three-year-old, 80 percent occupied garden apartments—multi-unit, low-rise dwellings with lawn or garden space—in Arkansas and East Texas.

The deal turned out to be even more profitable for Blackstone than Schwarzman had estimated, returning at least 62 percent on the investment every single year.

Schwarzman was so enamored by Blackstone’s first housing investment that went searching for more “opportunities”.

Robert’s gave him an answer and that answer was:

“There’s a whole country full.”

And yeah, a hell of a lot of boomers capitalized on the market as well.

So here were are, several decades later. Housing has been turned in to a competition for rich guys to be flipped for a profit, led by none other than the Blackstone Group.

Renting is no different. Long gone are the days of some grumpy old guy being your landlord. Now, large asset/estate management firms are your landlords whose only purpose is to squeeze as much money out you, the renter, until the property begins falling apart. Then they sell it to another company to does the exact same.

The result is a tiny apartment with a leaky roof, thin walls, water that’s never hot, pest infestations, overflowing dumpsters, cracked parking lots, moldy walls and windows that have just been painted over ten times, and increasing rent prices with an office that could care less about your complaints.

After all, they’ll just pay for a bunch of fake reviews on Google after you left an honest one when you finally escaped.

Conclusion

The end result of all of this has been a deteriorating house market with inflated prices, low supply, poor quality, and insanely expensive financing to top it all off.

Of course, housing isn’t the only thing affected. This is happening across all industries. Groceries, automobiles, electronics, everything.

Millions of Americans have resorted to alternative forms of living such as tiny homes and modular homes made out of giant cargo bins or even DIY kits from places like Home Depot, Lowes, and Amazon.

Some have chosen the off-grid lifestyle on a cheap piece of land far from major cities or civilization, choosing the old school ways, albeit with some modern upgrades like solar panels and portable power supplies.

Let’s not forget all of the van and RV nomads. Anything to avoid being a cardboard box dweller or a rat stuck on the hamster wheel that never stops.

It’s a true race to the bottom and the future doesn’t look very bright for most of us. It’s no wonder the numbers of suicides and expats (those who have fled the country) have exploded.

Sadly, it’s not even just America anymore. It’s becoming a global epidemic and eventually there will be no where else to run to.

But for those of us who choose to hang on and tough it out, we don’t have to sit back and take it. We still have the option of organizing and finding a way out of this mess. I don’t know of a solution for all of these problems but there are plenty of bright people out there with some great ideas.

I say we give some of them a shot because what else do we really have left to lose?

- Why Student Loans Are a Scam - January 18, 2026

- Nick Shirley Is a Retard - January 13, 2026

- Here Are All of the Epstein Files So Far - January 11, 2026