A couple decades ago, telling someone not to get a degree would have gotten you laughed out of a classroom. Things have changed since then. Student debt is at an all-time high while underemployment has skyrocketed.

While it’s still true that becoming a doctor or professor may pay off after years of dedication and debt, the majority of graduates aren’t so lucky.

As of today, there is a total of around $1.8 trillion of student debt, 91.6% coming from federal loans. This is almost four times the amount of debt from twenty years ago which was $520 million in 2006.

The idea of getting a degree has been ingrained in to the psyche of us for several generations. But now people are realizing that they have been conned and millions are regretting ever stepping foot on to that campus in the first place.

So without further adieu, let’s dive in to the many reasons why taking on the burden of student loans is not only a bad decision, but can ruin your life.

High Interest Rates

One of the most daunting aspects of traditional student loans is how interest accumulates over time. The repaid amount can far exceed the original loan amount for many borrowers. Numerous real-life instances exist where graduates shoulder the burden of repaying interest amounting to hundreds of thousands of dollars.

For the 2023-2024 academic year, the interest rates for federal student loans were set at 5.50% for undergraduates, 7.05% for graduate students using direct unsubsidized loans, and 8.05% for parents and graduate students using direct PLUS (Parent Loan for Undergraduate Students) loans.

This substantial interest burden can significantly extend the time it takes to become debt-free and can delay other financial goals, such as saving for retirement or buying a home.

Long-term Financial Burden

Traditional student loans often tie borrowers to an extended repayment period, sometimes up to 30 years. This long-term financial commitment can significantly affect a person’s life choices, such as buying a house or starting a family. With the extremely high cost of living and wages that can’t keep up, student loan payments often take up whatever extra money you have left to save or spend.

Need a repair for your vehicle or have your electricity rates gone up for the third time this year? Too bad, better pay your student loans or they will ruin your credit.

The impact on financial freedom is overwhelming.

Risk of Default

The risk of defaulting on student loans is a serious concern, with statistics showing a steady increase in default rates over the years. As of 2021, about 12% of student loan borrowers in the U.S. were in default.

Even worse, those who default on government loans, you know, over 90% of all borrowers will start having their paychecks garnished eventually.

Defaulting on a student loans has severe consequences. It can severely damage credit scores, making qualifying for mortgages, auto loans, or even some jobs difficult. Adding flame to the fire, student loans are typically not dischargeable in bankruptcy, making defaults something you can never get rid of.

Limited Flexibility in Repayment

Most traditional student loans offer very little flexibility in terms of repayment options. Borrowers are usually locked into a fixed repayment plan. Lost your job or took a pay cut? Too bad. Have your bills increased due to increased rent, groceries, and utilities? Sucks for you. Did you get cancer and are now drowning in medical debt? You have two options.

Pay those loans or you can fuck off and die.

Impact on Credit Scores

Student loans significantly impact a borrower’s credit score, the thing that determines an individual’s financial health. Regular, on-time payments can positively affect credit scores, but late or missed payments have the opposite effect. This impact is particularly important considering the large balances and long repayment periods associated with student loans.

When an 18-year-old has no student loans, they can obtain credit much faster and easier than someone who does. The teenager with no loans can open up a few secured $300 credit cards and within maybe six months, will have decent credit history. The recent graduate who has $20,000 to $100,000 in debt will have nothing to show except a high amount of debt with no repayment history.

Most of these graduates can’t even get a credit card or loan to pay back responsibly. Even if they somehow manage, the small amount of repayment history will get wrecked by their high student loan balances and poor credit age.

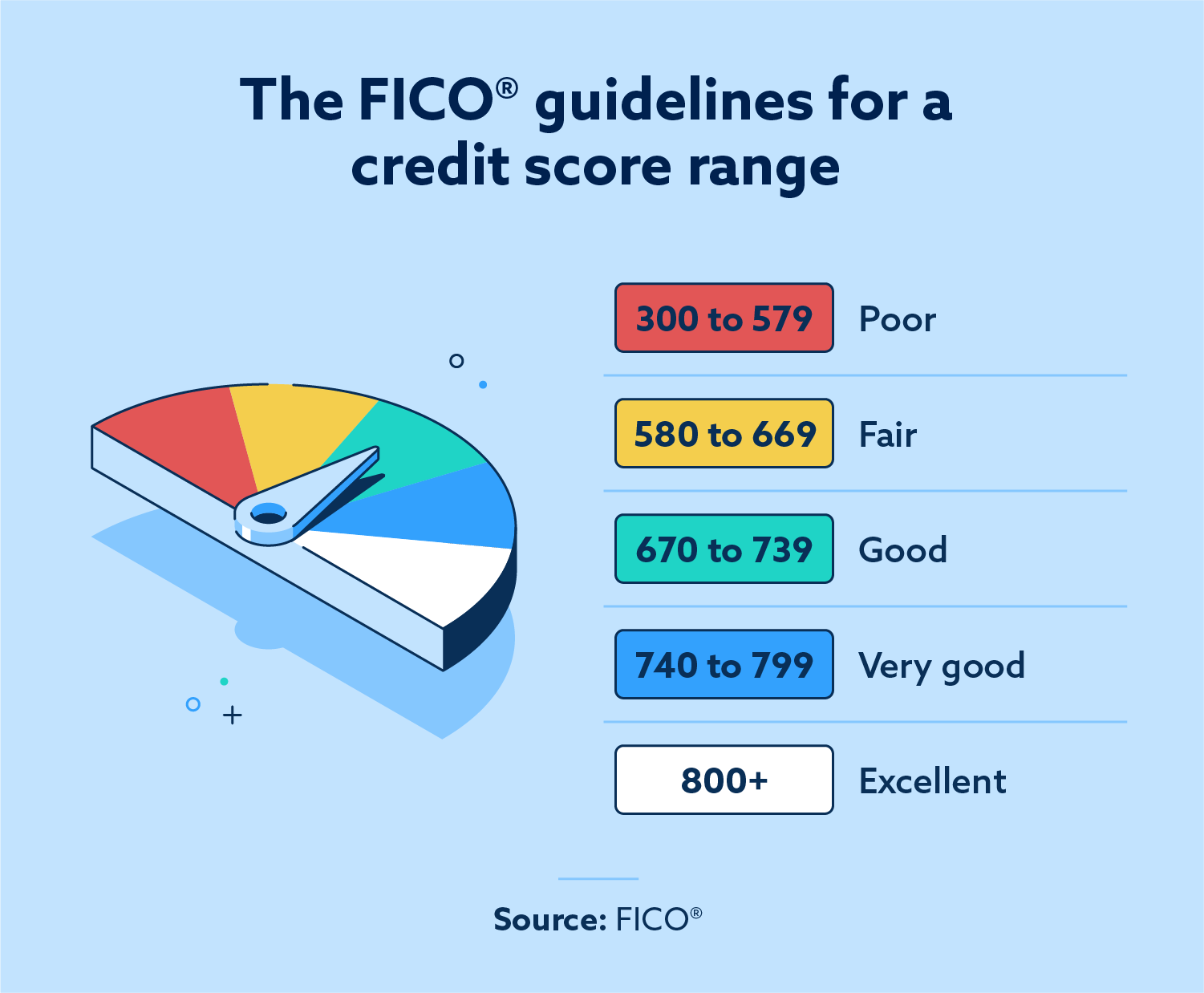

The person with no student loans ends up with a 700 credit score while the graduate ends up with a 500. You can’t get approved for basically anything with a score that low, especially a mortgage, which generally requires a 650 or higher.

It will take many years before the graduate is able to catch up.

Pressure on Career Choices

The necessity to repay student loans can put immense amounts of pressure on a graduate’s career choices. Many must prioritize high-paying jobs over careers that align with their passions or values. This dynamic can lead to a workforce more driven by financial necessity than professional satisfaction or personal fulfillment.

The result is more pencil pushers who contemplate suicide every day instead of entrepreneurs who take leaps of faith by creating small businesses that create more jobs.

We really need more of those those right now.

The country is losing hundreds of thousands of jobs every month due to business closures and AI, fueled by the increasing costs of literally everything.

Wages still haven’t caught up since COVID and the wealth gap is at the highest its ever been in nearly a century.

Inadequate Preparation for Real-World

A huge criticism of many traditional education systems funded through student loans is the gap between academic education and industry requirements. This often results in graduates who are well-versed in theory but less prepared for practical, job-specific skills.

When I was younger and working in hospitality, the amount of fresh graduates from culinary schools who were in immense amount of debt that had no actual skills when it came to the day-today operations of a restaurant was astounding.

They had knife skills and knew the five mother sauces but couldn’t take the pressure of working in a high-stress, fast-paced, kitchen 8-12 hours a day.

This meant that those of us who started as dishwashers and prep cooks still got promoted to sous or executive at the same rate, often even quicker.

One of the largest culprits in the culinary degree scams was a renowned French institution called Le Cordon Bleau which was forced to shut down all 16 of its locations in the U.S. due to its horrific practices of trapping students in high amounts of debt (around $90k) for degrees in the lowest paying industry.

This is just one example but the result across the board is that a lot of graduates struggle to find employment in their field of study, forcing them to question the return on investment (ROI) of their education.

For those who don’t know, return on investment is the amount of money you’ll make over your life compared to the someone who got a different degree or none at all versus the debt burden you took on.

Societal and Economic Implications

The impact of widespread student debt extends far beyond individual borrowers, affecting our entire society and the economy.

On a national scale, the economic ramifications of widespread student debt are significant. A heavily indebted workforce is less likely to spend on goods and services or invest in new ventures. The debt burden increases financial stress and decreases mental health among the population, further impacting societal well-being and economic productivity.

Better Alternatives to Traditional Student Loans

I’m not saying that pursuing some form of higher education is bad. In fact, it’s sadly necessary these days if you want to be more competitive in a shrinking job market. But these options don’t have to result in decades of debt.

Scholarships and Grants

Scholarships and grants are excellent alternatives to student loans as they do not require repayment. These funds can come from various sources, including governments, educational institutions, private organizations, and community groups.

To maximize the chances of receiving a scholarship or grant, it’s essential to start the search and application process early and usually involves you having academic achievements, community involvement, or specific talents and skills.

There are plenty of scholarships and grants for a wide variety of fields like healthcare and social services, paying out more than your typical federal grant such as the Pell.

I’m sure many of us know someone who got a full-ride scholarship.

Work-Study Programs

Work-study programs offer a unique balance between employment and education. They allow students to gain work experience while studying. These programs typically involve part-time jobs related to a student’s field of study or roles contributing to their college or university. These positions provide a source of income and offer valuable work experience without taking on as much debt or any at all.

Not only that, students often gain relevant skills, professional contacts, and practical experience in their chosen fields, which enhances their employability post-graduation. I’d like to emphasize on the professional contacts part because when it comes to success in this country, it’s often WHO you know, not what you know.

Sure, Tom the customer service rep that’s had a solid performance record for the past three years fits all the qualifications for a promotion to department head, but he’s not the one who goes to the company President’s birthday party every year and even baby-sat his kids once when he took that much needed vacay to Cozumel. You did, and even though you show up late often, fall asleep sometimes at your desk, and have no idea how to use Microsoft Excel, you’re the one whose first in line.

Corporate Sponsorship and Employer Tuition Assistance

Corporate sponsorship and employer tuition assistance programs are innovative ways businesses contribute to employee education. A lot of companies offer to finance part or all of an employee’s education, based on the recognition that the skills gained can be valuable to the organization. Now, this might be a long shot and I haven’t personally seen too many folks get this kind of treatment even though it was promoted by HR or hiring managers, but there are definitely some who were able to take advantage.

This is because data shows companies that it leads to higher retention rates and improved employee performance. For example, Starbucks College Achievement Plan, in partnership with Arizona State University, offers full tuition coverage for its employees. Why would anyone want to work at Starbucks the rest of their life? I have no idea, but hell, if it gets you a degree for cheap or for free, you better eat, sleep, and breathe caramel macchiatos until that paper is in your hand.

Online and Community College Courses

Online and community college courses are low cost and flexible learning options for students. While statistically, graduates with Associates degrees make less than those with Bachelors, they still make more than those with just high school diplomas and pay significantly less for those degrees. Popular community colleges like Lone Star in Texas cost around $3,000 for a year’s tuition if you live here.

Given that basically everyone is approved by FAFSA for Pell Grants, it makes attending the college completely free. You even usually get a good chunk of change back since Pell pays out up to $7,395 a year. This covers books, laptops, and even some bills if you’re living on your own.

Vocational and Technical Training

Even better, these same colleges usually offer trade programs which often take from six month to a year and cost very little compared to a traditional degree.

Companies down here in Texas love to pay for these kinds of programs for their employees. Popular trades like trucking, electrical engineering, plumbing, HVAC, and pipefitting are often covered by employers and the same federal or state grants.

While many of these trades don’t pay as well as they used to, they’re still generally enough to make a decent living and still have large unions you can apply to join as well. Often, these union jobs come with incredible benefits aside from job security and can pay $40-60 an hour.

In a time when so many have to work multiple jobs to stay afloat and never know if today is the day that they will be laid off or fired, landing a union job feels like like hitting the lottery.

Why go in to debt $50,000, spend the next ten years fixing your credit, and thirty years paying off the debt, just to end up working in an office making $45k a year when you can work your way up to a tenured driver at UPS making nearly $50 an hour with a pension, house, paid off car, and co-workers who aren’t trying to stab you in the back every chance they get?

The importance of these courses in the modern job market cannot be understated.

Income Share Agreements

Income Share Agreements (ISAs) present a unique approach to funding education. In an ISA, a student agrees to pay a percentage of their future income for a set period after graduation in exchange for funding their education. This model shifts the focus from fixed debt repayment to a flexible arrangement based on the graduate’s earning capacity.

Compared with traditional loans, ISAs offer several advantages. They typically come with a cap on total repayments and provide a safety net, as payments are reduced or paused if the graduate’s income falls below a certain threshold. This system can offer peace of mind to students, as their repayments are directly tied to their post-graduation success.

Bootcamps and Accelerated Learning Programs

Bootcamps and accelerated learning programs offer intensive training in high-demand skills like coding, digital marketing, and data science. These programs are designed to be short-term yet highly focused. The fast-paced nature of these programs makes them ideal for those looking to transition into a new career swiftly.

For example, becoming a programmer or software engineer is really daunting for those with little mathematical knowledge, yet when I was in high school there was a huge emphasis on getting a degree in something like Computer Science because technology was the future.

They weren’t wrong but the reality ended up being that there were far too many underqualified graduates and far too little jobs. Not only that, lower level career paths like data entry were replaced by automated software.

This meant that only the most talented in the hiring pool were brought on to companies such as Google, Microsoft, etc. Tons of graduates for CS are in immense amounts of debt and ended up having to settle for jobs not related to technology at all.

When considering the ROI, bootcamps and accelerated programs often fare better than traditional college degrees. Many graduates find they can recoup their investment relatively quickly due to the high demand for the skills they’ve acquired.

At the end of the day, your degree matters a lot less to tech companies if you don’t know how to code. And most of the founders of big tech never even got degrees themselves, because skill is most important.

These bootcamps are kind of testing grounds to determine if the career path is even right for you and if you realize that writing hundreds of pages of code in Assembly every single day is either too boring or overwhelming, you lose very little aside from your time.

Self-Funded Education Through Part-Time Work

Lastly, pursuing self-funded education through part-time work is another viable alternative to student loans. This approach involves balancing work and study, allowing students to pay for their education as they go. It requires careful time management and dedication but can be highly rewarding.

The most obvious long-term benefit of self-funding education is the avoidance of debt. Students who work part-time develop valuable work experience and life skills while funding their studies, which can be advantageous when entering the job market.

Conclusion

When realizing how many other opportunities exist for someone in America to attain a decent job and still attain some semblance of the ‘American Dream’ aside from going down the high-debt, high-risk, and low reward path of a traditional degree, one can easily see how student loan debt is not only a trap, but a scam.

A scam that is being pushed by educational institutions which have created an entire system of slavery by forcing graduates in to a cycle of debt they can never escape while simultaneously sucking our government dry of tax money that it simply can not afford.

As of me writing this article, the U.S. debt is over $3.6 trillion. That number isn’t shrinking any time soon and neither is your tax burden. But at the end of the day, our government can always raise the debt ceiling with no real consequences since our dollar is the global trading currency.

You on the other hand can’t raise your debt ceiling without getting approval from a bank and you certainly can’t have your debt payments delayed indefinitely.

One thing the Biden administration did right was pushing for mass student loan forgiveness because grooming children and teenagers their entire lives to go to college, then giving them tens to hundreds of thousands of dollars, trapping them in to a system where only a small percentage could ever pay of their loans was wrong.

By resetting the debt, it gives us a chance to reeducate the youth and teach them of the plethora of better options like the ones I listed in this article so that they do not make the same mistakes many of us did.

Unfortunately, the Trump administration wants everyone to pay the loans back and millions who were unaware have already defaulted. Unless someone else changes tune, things aren’t going to get better for graduates and undoubtedly, the economic situation for everyday Americans will only get worse when everyone is forced to repay.

Decreased credit scores, more homeless, and even less spending to stimulate the economy. Lenders will either be forced to decrease their credit requirements or even less Americans will be capable of getting mortgages, auto loans, etc.

It is more imperative than ever that we educate our children and future generations on the student loan scheme and assure that they make the smartest decisions possible when it comes to their futures.

- Pam Bondi and Kash Patel Are Protecting Elite Pedophiles - February 12, 2026

- Why the Dead Internet Theory Is True - February 11, 2026

- Why Republicans Will Lose the 2026 Midterms - February 8, 2026