Elitist Wesley LePatner, a star executive in Blackstone’s real estate business, was among those killed on Monday by gunman Shane Tamura who entered the company’s Park Avenue offices. Mainstream Media reports that Tamura was attempting to target the NFL headquarters, which is located on floor five of the building. This is an obvious and blatant lie. It was clear who Mr. Tamura was targeting on the 33rd floor and it appears as if he hit at least one of his intended targets.

LePatner attended the elite NYC private school Horace Mann and Yale University. She joined Goldman Sachs following her graduation, where she worked for over a decade. She joined Blackstone in 2014 when its core assets portfolio, which invests in commercial properties like warehouses, office buildings, rental housing, and hotels, was a nascent investment category.

She assisted in launching the fraudulent BREIT in 2017, which has become a major piece of the private equity firm’s push to attract funds from wealthy individuals. Business Insider profiled LePatner in 2022 as a power player in Blackstone’s real estate team.

What Is Blackstone?

Blackstone Group is an American alternative asset management company based in New York City. It is the world’s largest alternative asset manager, with over $991 billion in assets under management (AUM) as of March 31, 2023. Blackstone’s four primary businesses are:

Private equity: Blackstone invests in private companies, both in the United States and internationally. It has invested in a wide range of industries, including financial services, healthcare, industrials, and real estate. The Private Equity division of Blackstone invests in companies across various sectors, aiming to enhance their value and generate attractive returns for its investors. Blackstone’s extensive network, operational expertise, and access to capital enable it to actively partner with management teams to drive growth, operational improvements, and strategic transformations in the companies it invests in.

Real estate: Blackstone is one of the largest real estate investors in the world. It owns and manages a portfolio of over 12,000 properties, with a total value of over $600 billion. The Real Estate segment of Blackstone is one of the largest real estate investment managers globally. It engages in the acquisition, development, and management of a wide range of real estate assets, including commercial properties, residential properties, hotels, and logistics facilities. Blackstone’s real estate investments span across different geographies and property types, and its expertise lies in identifying undervalued or underperforming assets and implementing value-enhancing strategies.

Hedge funds: Blackstone offers a variety of hedge fund products, including traditional long/short equity funds, event-driven funds, and fixed income funds. Hedge Fund Solutions is another important division within Blackstone, offering customized hedge fund investment solutions and advisory services to institutional and individual investors. Blackstone’s hedge fund platform includes a diverse range of investment strategies, such as long-short equity, credit, macro, and multi-strategy funds, aiming to generate attractive risk-adjusted returns for its clients.

Credit: Blackstone invests in credit markets, including corporate debt, distressed debt, and structured credit. The Credit division focuses on investments in corporate credit, distressed debt, direct lending, and non-performing loans. Blackstone seeks to capitalize on opportunities arising from dislocations in credit markets, distressed situations, and special situations where it can provide tailored financing solutions to companies and generate attractive risk-adjusted returns.

Blackstone was founded in 1985 by Stephen A. Schwarzman and Peter G. Peterson. The company has grown rapidly over the past few decades, and it is now one of the most influential financial institutions in the world. Blackstone’s investments have had a significant impact on the global economy, and the company has been criticized for its role in some of the most controversial deals of recent years.

Despite the controversy, Blackstone remains one of the most successful alternative asset managers in the world. The company’s strong track record and deep resources have made it a go-to destination for investors.

A History of Corruption

Investment In NSO Group

In August 2017, Ahmed Mansoor, a human-rights defender based in the United Arab Emirates, received a text message from an unknown phone number. The SMS promised “new secrets about the torture of Emiratis in state prisons,” and included a hyperlink to an unfamiliar website.

Mansoor wisely didn’t click the link. He took a screenshot of the message and sent it to an investigator at Citizen Lab, a digital rights group at the Munk School at the University of Toronto, which had helped identify previous hack attacks on Mansoor’s phone. With this link and his help, they would eventually uncover the work of a mysterious seven-year-old Israeli company, NSO Group, that has built its business on the back of one product: a spyware suite known as Pegasus.

“Anything you can do on the phone, Pegasus can do on your phone,” says John Scott-Railton, a senior researcher at Citizen Lab, which released its initial findings on the spyware in August 2016. “Turning on the camera and watching somebody in the room, turning on the microphone and listening to somebody: It can even do some things that you can’t, like put files on the phone and take files off, to manipulate data on the phone.”

By reading messages and listening to calls either before or after they are encrypted, Pegasus can foil encryption; by deleting itself, it can foil forensic researchers trying to understand it. Those who analyzed it called it the most sophisticated commercial spyware at the time.

Pegasus probably hasn’t been installed on your phone. NSO says it only sells to governments for legitimate reasons, like spying on criminals and terrorists, and that it complies with Israel’s export rules. The spyware’s not cheap either: According to a price list seen in 2016, NSO charged customers $650,000 to hack ten devices, on top of a $500,000 installation fee.

But the growing and loosely regulated market for Pegasus and other cyberweapons also represents a serious risk, say security experts, an upgrade to the age-old dilemma surrounding any legitimate arms sales: what happens to a weapon after it’s been sold?

“What is concerning is that there is a gold rush right now to invest in companies doing offensive spyware stuff,” said Scott-Railton. “It’s happening without a lot of attention paid to the ethical and human-rights risks.”

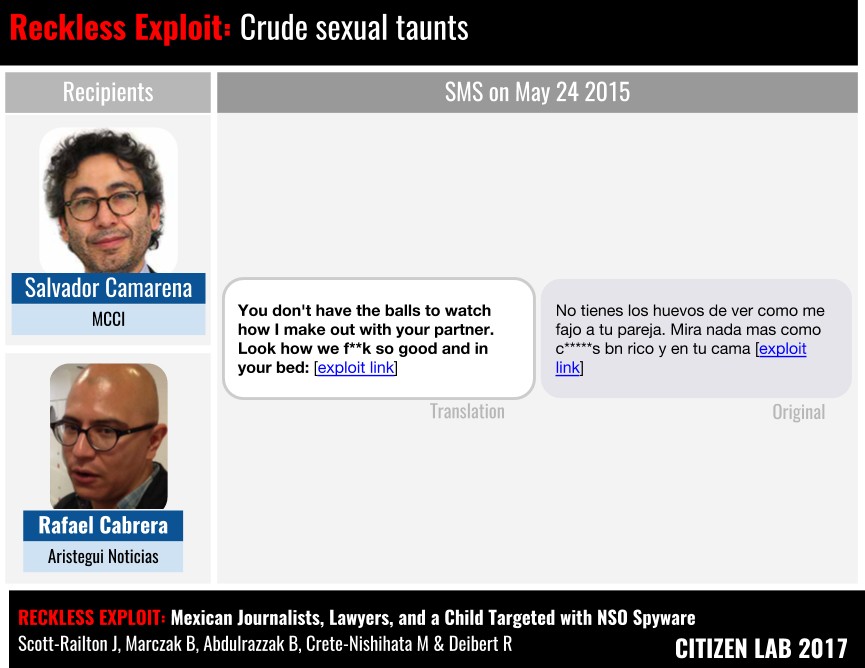

In June 2017, Citizen Lab and the New York Times reported that Mexican government officials had used Pegasus to spy on the mobile devices of journalists, human-rights activists, lawyers, and others looking into murders, corruption, and the disappearance of dozens of college students. Pegasus had even been deployed against the phones of scientists and public health campaigners who supported measures to reduce childhood obesity, including Mexico’s “Soda Tax.” Since 2011, the Times reported, at least three Mexican government agencies paid NSO Group $80 million for the software.

In a statement, NSO said it only sells to “authorized” government customers and denied having any knowledge of the attacks in Mexico. President Enrique Peña Nieto called for an inquiry, even as he insisted that surveillance software had only been used in cases involving national security and organized crime. Lately, however, the investigation has been slowed by what forensic experts say is an unnecessary demand—that victims turn over their phones—and so far, no one has been charged with any wrongdoing.

“We Don’t Talk To Journalists”

Mexico and the UAE aren’t the only countries where commercially made, government-only cyberweapons have been aimed at activists and lawyers, and NSO isn’t the only company making this kind of software: Citizen Lab has also helped investigations into abuse of spyware made by the Italian company Hacking Team and the Munich-based Gamma Group.

“This is an industry where the narrative of companies that sell government-exclusive spyware is, ‘We sell this to support criminal investigations and track terrorists,’” says Scott-Railton. “But in practice, many governments lack the oversight that prevents them from using it in ways that are clearly abusive and have nothing to do with national security.”

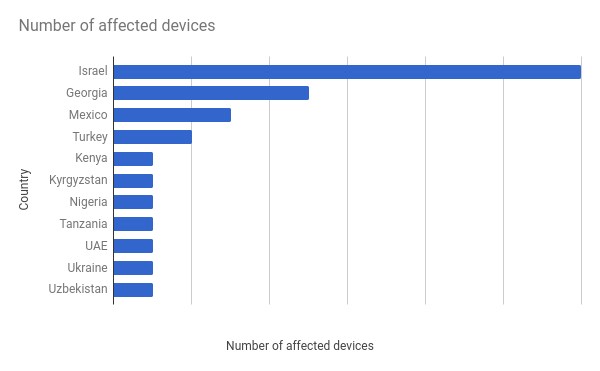

NSO doesn’t disclose its clients, but according to Citizen Lab it has registered web domains, presumably for hacking purposes, in a number of countries with dubious civil rights records, including Uzbekistan, Bahrain, Kenya, Saudi Arabia, Nigeria, Turkey, Qatar, Yemen, Hungary. In 2013, NSO executives told the Financial Times they had visited about 35 countries over the previous 18 months. (In the UAE, Mansoor, the activist targeted by Pegasus, was detained by authorities in March on charges of “cybercrimes” and using social media to “publish false information that harm national unity and damage the country’s reputation.” Amnesty International said it feared he was being held in solitary confinement and was at risk of torture.)

Like many of Israel’s cybersecurity startups, NSO was founded in 2010 by three veterans of the Israeli military’s signals interception group Unit 8200, Omri Lavie, Shalev Hulio, and Niv Carmi. Today, the company has over 200 employees at its headquarters in the coastal startup hub of Herzliya, according to its LinkedIn profile. A sales arm based in Bethesda, Maryland, WestBridge Technologies, sells “top-of-the-line technologies to various government agencies in North America, particularly in the U.S.,” its LinkedIn profile says.

Emails obtained by Motherboard show that at some point before January 2015, WestBridge met with U.S. Drug Enforcement Administration officials to pitch its software. There is no evidence however, of what, if any, deals NSO has entered into with U.S. agencies.

NSO did not respond to emailed questions from Fast Company, and Lavie, the company’s cofounder and U.S. representative, did not reply to questions sent to him via Twitter. A person who answered the phone at the Bethesda office was curt: “We don’t talk to journalists.”

NSO’s government ties have also made a cameo in ongoing inquiries into the 2016 Trump campaign. Lieutenant General Michael Flynn, the former Trump campaign and White House adviser, served as an advisory board member to OSY Technologies, an NSO Group offshoot based in Luxembourg, from May 2016 until January 2017. According to financial disclosure forms, Flynn received $40,280 for work completed while he was working for the Trump campaign, and just prior to his ill-fated stint as President Trump’s national security adviser. Flynn also provided consulting work to Francisco Partners, the San Francisco private equity firm that owns NSO Group, for “less than $100,000,” Francisco’s general counsel told the Times.

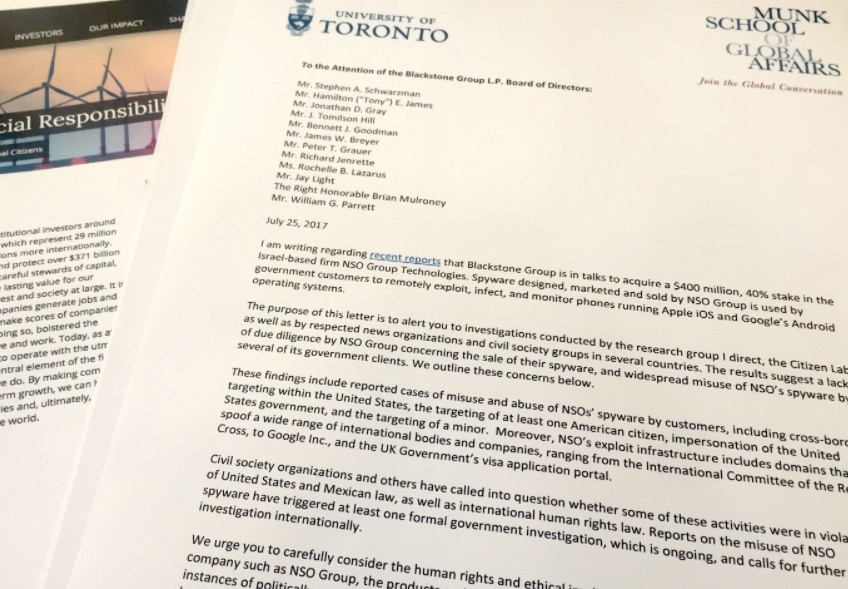

A year after it bought NSO for around $120 million in 2014, Francisco began exploring a sale of the company. Earlier this year, it entered into discussions about selling 40 percent of NSO Group for $400 million to Blackstone Group, the New York-based private equity firm, a deal that would have valued the company at about $1 billion. The sale was scuttled in August after human rights groups, including Citizen Lab, protested.

Then, in 2017, Lavie emerged at a cyber conference to announce he was launching a new startup, Orchestra, dedicated to cyber defense.

“I think even from a business perspective, there is clearly risk in this space,” says Scott-Railton, “and we find it very troubling, and we think investors would be concerned too.”

How They Found It

When Mansoor received that text message in August, Citizen Lab investigator Bill Marczak had already been investigating a number of suspicious servers that, it would turn out, were part of the Pegasus’s command and control infrastructure. As he and Scott-Railton revealed in a report that month, “The Million Dollar Dissident,” infiltration attempts with Pegasus begin with a link sent to a target, in the form of a tweet, an innocuous email, or a taunting text message. Once opened in the phone’s web browser, the link connects to one of those servers, where software determines the type of device and installs a remote exploit for the specific operating system.

Not long after that report, a group of researchers in Mexico contacted Citizen Lab, through Amnesty and the human-rights group Access Now, to share suspicious text messages they had collected.

“The initial scan that Bill had done left a list of servers that were also part of the NSO exploit infrastructure, so they were spotted to a fingerprint that matched that infrastructure,” said Scott-Railton. “And so we began to look around for other instances of this, and found evidence that something had been happening in Mexico.”

From there, the researchers—from digital rights outfits R3D, Social Tic, and Article 19—would help Citizen Lab determine that over 20 individuals had been improperly and “abusively targeted” with NSO’s spyware. While Mexico, like many other countries, requires individual judicial approval for use of such surveillance, several former Mexican intelligence officials told the Times that it was highly unlikely that the government received such approval for the hacks.

In April of 2017, Google said it had found Android versions of Pegasus, called Chrysaor, on “less than three dozen” devices in a wide range of countries, including Mexico, Georgia, Turkey, Kenya, and Ukraine, and Tanzania. One feature of the spyware, “RoomTap,” answers a phone silently, says Google, “and stays connected in the background, allowing the caller to hear conversations within the range of the phone’s microphone.”

Like Pegasus, Chrysaor was “one of the most sophisticated and targeted mobile attacks we’ve seen in the wild,” said Mike Murray, vice president of security intelligence at Lookout, which helped Google discover the spyware.

Apple and Google issued security patches to address the zero-day vulnerabilities NSO had exploited, but given the open-source nature of Android, many of those devices had never received recent security updates. Since Pegasus was first deployed, at least ten years ago, security researchers says it’s likely that NSO and other cyber arms makers have developed even more sophisticated techniques.

The Panamanian government has also been caught using Pegasus to hack citizens’ smartphones, alongside a similar weapon by the Italian company Hacking Team called RCS. In 2015, the government of Panama opened an investigation into its former president, Ricardo Martinelli, for running a personal NSO deployment out of a secret office, from which he spied on a number of opponents, including Americans. After receiving a daily briefing with all the doings of his political enemies, Martinelli would even sometimes order subordinates to upload the most salacious material to YouTube.

“Now, that’s already a very problematic track record,” says Scott-Railton. “And NSO is not the first company to sell this stuff and then have it abused.”

Companies like NSO are seeing swelling markets for cyber weapons. Globally, according to the a forecast from Gartner, spending on information security products and services, including both offensive and defensive measures, reached around $86.4 billion in 2017, an increase of 7% over 2016.

Big Blackstone Deal Scuttled

In June 2017, after reports emerged that Blackstone Group was in negotiations with Francisco Partners to buy part of NSO Group for $400 million, Access Now launched a petition to put pressure on the private equity firm to drop its plans. In its own letter, Citizen Lab told Blackstone that NSO was unable to prevent customers or others from misusing its spying tool, and drew the firm’s attention to over 20 publicly documented cases of reckless misuse of its spyware.

“We would expect such a track record to trigger exceptional due diligence by an American company, and we asked Blackstone if they had done so,” says Scott-Railton. “We also asked what oversight Blackstone proposed to implement to prevent future misuse, if the purchase had gone through.”

A month later, Reuters reported that Blackstone had pulled out of the deal. The investment firm didn’t comment on the letter or the reasons for its decision not to invest in NSO. But when asked by a reporter for Israel’s Haaretz in October 2017 if NSO would have still sold its technology to Mexico in retrospect, one unnamed executive affiliated with the company was emphatic: “No,” they said.

“This research is a reality check to the NSO customers, the same way the reality check happened for Hacking Team and Gamma Group’s customers, which is that it’s not as untraceable as the marketing materials propose,” says Scott-Railton. “And we can say that the NSO saga generally highlights the business, ethical, and human rights risks that come from investing in commercial spyware like NSO.”

Under Israel’s export laws, deals by companies like NSO are supervised by SIBAT, a regulatory body charged with both promoting and reviewing all weapons exports. NSO also has an “ethics committee” that reviews every deal before it is carried out, according to one company official who spoke with The Marker.

But Scott-Railton says companies like NSO must institute more thorough vetting processes. Given the history of abuse of spyware like Gamma Group’s Finfisher and Hacking Team’s exploits, any cyber weapons maker must be aware of the potential for abuse, he says, arguing that each of the three cases he’s investigated—Mexico, United Arab Emirates, and Panama—demonstrates a failure of due diligence.

“What my colleagues and I say informally is, there is the principle of misuse, where it’s only a matter of time if you sell this kind of software to a government that doesn’t have very rigorous rules in place before it gets misused,” adds Scott-Railton. “It’s clear that the industry that sells the commercial spyware to governments is not wired to take that very basic fact into account and mitigate it.”

And if companies like NSO become aware of abuse, he adds, they should also take affirmative steps to stop it. Otherwise, he believes, it’s a foregone conclusion that exploits like Pegasus will be misused.

Real Estate Market Takeover

Predatory private equity firms buying up neighborhoods only to rent homes at a premium hints at the real meaning of the World Economic Forum’s “sharing economy.” Americans never voted for this, but their leaders are loving it.

Owning a home is no longer feasible for Americans coming of age in the 21st century, according to Bloomberg columnist Karl Smith, who smugly suggested in an op-ed that they stop worrying about whether they can afford a house, ignore the asset-stripping investment vultures, and just embrace the depressing reality of lifelong debt peonage under the rule of those same private equity giants.

Lest there be any misunderstanding, the feudalist character of this glorious new “sharing economy” is reflected in one increasingly popular “solution” for the generation currently facing the steep uphill climb to pay off their student loans. Under this scheme, known as Student Loan Asset Backed Securities (SLABs), students are invited to essentially indenture themselves to some corporation, paying off their debts by selling off a percentage of every paycheck they subsequently receive until the balance is zero. Any questions?

Feudalism for Thee, But Not for Me

With multi-trillion-dollar asset managers such as BlackRock, Blackstone Group, State Street, and Vanguard flaunting their bottomless pockets, ordinary mom-and-pop landlords looking to buy an extra property or two to open up a guaranteed income stream don’t have a chance in such a rigged market – and neither do their tenants.

Just as they did after the 2008 mortgage implosion, giant corporations are sprouting up everywhere, snatching for-sale homes off the market sight unseen, paying a hefty premium to do so, then turning around and charging fee-laden premiums to the new tenant for what, in pre-“new-normal” times, would have been considered the landlord’s responsibility.

But even with the dark truths of the so-called “sharing” or “stakeholder” economies on display for all to see, Smith sees absolutely nothing wrong with this model, indeed suggesting Americans should be grateful for the opportunity to submit to this shiny neo-feudalism. Smirking at the idea of a required “revision of the American dream of homeownership” – that is, dispensing with the idea of dreaming of a better life altogether – Smith quipped that “this country was always more about new frontiers than comfortable settlements, anyway.”

Conor Sen, another Bloomberg columnist floating by on his own smugness, came to similar conclusions, dismissing the fact that filling up an area with cheap, low-quality housing wrecks the market value of nearby homes by explaining that the landlord would somehow “take care of that.” But home ownership has long been considered one of the only ways – if not the only way – for young people to build up the equity required to start accumulating real wealth in the US economy. Houses are unlikely to seriously or rapidly depreciate in value, unless bought just before a speculative bubble bursts, but if the apartment you’re renting is worth more over time, you don’t see a penny of the increase – indeed, your life might actually become more difficult as speculators start circling your rented home.

Renting from disinterested private equity giants such as BlackRock, the world’s largest asset manager, and Vanguard, its privately owned counterpart, is putting oneself at the mercy of a faceless slumlord with vanishingly little financial interest in fixing what’s broken in any given apartment they own. Tenants have complained to the media about spurious rent hikes, evictions without notice, and delayed or never-completed repairs – and the problem is by no means limited to the U.S., or even North America, according to a United Nations working group.

But according to Smith, this all pales in light of the magic of renting, driven by the company’s own very special “risk-monitoring software,” dubbed Aladdin – a supercomputer that will grant you three wishes (as long as none of them are “make me a homeowner”). No cumbersome house to sell when you want to pull up the stakes and move to another state! No messy refugee camps! The very features that made houses an affordable and stable investment are coming to an end, he insists, embracing the change like someone who’ll never have to deal with its consequences.

The practice of buying homes at jacked-up prices only to turn around and rent them to people who can barely afford the cost of the home itself, let alone the heaps of spurious fees tacked on, is not new, but it’s been growing rapidly over the past decade, turning asset managers into some of the country’s biggest landlords.

Blackstone subsidiary Invitation Homes was buying entire neighborhoods at a clip just a few years after the 2008 mortgage crisis sent homeownership into a death spiral. Helping that death spiral along, it treated its new tenants with all the warmth and benevolence of a hungry saber-toothed tiger.

The company supposedly quit the real estate market in 2019, selling off Invitation Homes to cheers from those who’d been living under its thumb – but the tenants who’d rejoiced at getting its boots off their neck did so prematurely. The firm returned to the single-family rental market with a massive investment in a group called Tricon just a few months later, and other private equity companies then joined in the feeding frenzy, driving up property values in cities all over the country, to the frustration of those merely trying to find a nice place to settle down.

Having nabbed the coveted post of running the U.S. Federal Reserve’s special investment vehicles under the CARES Act last year – not once, but thrice – BlackRock is rapidly outpacing its progenitor, Blackstone, in terms of sheer rapacious asset-stripping. Massive asset managers such as Vanguard and State Street have so much money one might think they’re literally running out of things to spend it on – but the firms’ return to manipulating the market suggests more sinister machinations are at work.

Far from running out of things to purchase, the private equity coteries are reducing entire industries into vertically integrated, dehumanizing life cycles. Groups like Blackstone and BlackRock are following in the filthy footsteps of the Sackler family, whose Purdue Pharma got hundreds of thousands of Americans addicted to opioids only to turn around and patent a new delivery system for addiction treatment. Likewise, BlackRock and Blackstone have meticulously made money on both ends of the ongoing real estate steal – er, deal, cashing in when a family leaves in disgust at their landlord’s nickel-and-diming and minting of fees out of thin air.

That said, when you have more money than God, there’s always more to buy, and Blackstone last year set about acquiring a chain of self-storage facilities via its real estate unit, essentially betting that the long-delayed tidal wave of Covid-19 evictions would leave Americans with nowhere to go and preferring their stuff stashed in a shipping container rather than strewn across their lawn. The private equity firm had the chutzpah to praise the “resilient” nature of self-storage – apparently trying to paint the disenfranchisement of the American population as a net positive for the environment. Presumably, people will be living in these shipping containers alongside their ‘stuff’ in the near future – if they aren’t already.

Stop the Insanity?

Between the specter of 2008 repeating itself and the flood of near-worthless paper exiting the money printer over the past year, it’s hard to imagine the US pulling itself up out of this particular financial hole any time soon. Especially with events unfolding religiously in line with the path financial institutions took in 2008, the phenomenon of “regulatory capture” ensures history will repeat itself over and over again.

So, what does that mean for ordinary Americans? An attack of déjà vu (and a visit from the sheriff’s department) are almost guaranteed – and, once again, no one will talk about it until it’s too late. News outlets such as the Wall Street Journal, The Atlantic, and even Vox have struggled to deploy detachments of euphemisms in such a way that the population feels a little less doomed, but that’s a tall order when the Federal Reserve has poured more cash into the market in the past year than in the first century of its existence.

The private equity vultures’ controlling stakes in the most influential media organizations explain why there are so many trite headlines downplaying the activities of beasts like BlackRock instead of calling it what it really is: a shadow Federal Reserve, capable of foisting debts incurred through risky trading on the average citizen’s savings, but never ever allowing the ordinary citizen to share in the spoils of victory.

That leaves the average American languishing in pod apartments in overbuilt cities, where – as the now-ubiquitous World Economic Forum coming-attractions roll for the New World Order (their words, not mine) never tired of saying, “You’ll own nothing, and you’ll be happy.”

Where Is This Going?

What do you get the private equity giant who literally has everything? These companies’ takeover of the real estate market is an ominous harbinger of the World Economic Forum’s “Great Reset,” in which the individual is gradually stripped of the few rights and assets they still have and lulled into passivity. We are staring down at the corpse of the American Dream, tied like a trophy hunter’s kill to the roof of our new electric vehicles (leased, never owned!), unaware that what we are looking at is our own future. Efforts to present this atrocity as either “new” or “normal” have been found wanting over the past year, and it seems all but impossible that that element of the New Normal will be achieved – but humans are adaptable creatures, and we can con ourselves into pretty much anything.

Lobbying Activities

As one of Wall Street’s largest private equity firms, the Blackstone Group has made a series of moves such as Blackstone’s hire of David Urban, a Washington lobbyist with close ties to the Trump administration.

Blackstone’s courting of a Trump ally was not surprising given that the firm’s CEO, Steven Schwarzman, donated $3 million to Trump’s re-election efforts and had previously chaired the President’s now-defunct Strategic and Policy Forum of “business leaders” and advisors. The close ties that have developed between Schwarzman and Trump following the latter’s election in late 2016 have led mainstream media to describe Schwarzman as a confidant of the President.

However, what was odd about Blackstone’s hiring of David Urban was its murky reason for doing so, as the firm planned to task Urban with lobbying the Pentagon and State Department on “issues related to military preparedness and training.” This is odd, as CNBC noted, because Blackstone “doesn’t have any publicly listed government contracts, and its known investments don’t appear to have direct links to the defense industry.” However, Urban has extensive experience in dealing with both Departments in addition to his close ties to the current administration and the fundraising apparatus of the Republican Party.

While media reports on Blackstone’s recent hire of Urban were unable to elucidate the motive behind Blackstone’s sudden desire to court the Pentagon and State Department, they did note that Blackstone’s previous hire of a Trump-connected fundraiser lobbyist, Jeff Miller, had been remarkably successful earlier this year, with Miller lobbying Congress specifically on coronavirus relief legislation like the CARES Act. The CARES Act ultimately allowed private equity giants like Blackstone to access funds designated for coronavirus relief, likely thanks to the efforts of Miller and other lobbyists hired by Blackstone as well as other private equity giants like the Carlyle Group.

Though CNBC was left looking for answers as to Blackstone’s sudden interest in aiding the Pentagon with “military preparedness” and wooing the State Department, the likely motive may be related to other moves made by the company, such as the hire of former Amazon and Microsoft executive Christine Feng. Feng, who was hired by Blackstone on August 3, 2020 previously led data and analytics mergers and acquisitions at Amazon Web Services (AWS), which is a contractor to the U.S. intelligence community and other U.S. federal agencies. Previously, Feng was a senior member of Microsoft’s Corporate Development team. Microsoft recently won lucrative contracts for information technology (IT) services and cloud computing for the State Department and Pentagon, respectively.

According to Blackstone executives, the decision to hire Feng was made due to her “deep relationships in Silicon Valley” and “her experience working at Amazon and Microsoft.” They also added that her hire was motivated by Blackstone’s push to “identify new opportunities to invest and partner with innovative companies reshaping the world” and Blackstone’s recent effort to “double down” on tech sector investments. Notably, Feng’s hire came just a few months after Blackstone had hired Vincent Letteri, another tech-focused investor experienced with growth-stage tech companies, and amid a series of recent investments by Blackstone in tech firms, including HealthEdge software and Chinese data center provider 21Vianet, among others.

Schwarzman’s Push for “Common Governance”

It strongly appears that Blackstone’s moves, including Urban’s hire, are part of the firm’s bid to become one of the top “innovative companies reshaping the world” as the Artificial Intelligence (AI) arms race becomes a key driver in the “reshaping” of the global economy. Blackstone’s Steven Schwarzman is a key part of the relatively tight-knit group of billionaires and influential political figures, like Henry Kissinger and Eric Schmidt, that are working to create a “global compact on the research, introduction, and deployment of AI,” and Schwarzman has heralded the coming age of AI as representing a “fourth revolution” for humanity.

Schwarzman argued for greater global collaboration on AI-driven technologies, particularly between the U.S. and China, in a July 2020 Op-Ed for Yahoo! Finance where he wrote that the establishment of “common governance structures” for the research, introduction and deployment of AI is necessary if “we are to avoid the negative consequences of AI,” ultimately comparing the current pace of development of AI to that of past arms races, such as those involving nuclear and biological weapons.

Per Schwarzman, these “common governance structures” would produce “explicit global commitments, agreements, and eventually international laws with consequences for violation” that relate directly to AI and its use.

Blackstone’s head is convinced that these “common governance structures” should be built between the U.S. and China, hence his heavy investment in universities and artificial intelligence education in both countries. For instance, Schwarzman created the Schwarzman Scholars program in 2016 where around 100-200 students from around the world pursue a Master’s Degree in Global Affairs at Tsinghua University in Beijing annually. The official goal of the program, which was modeled after the Rhodes Scholars program, is to “create a growing network of global leaders that will build strong ties between China and the rest of the world.”

The program’s advisors include former Secretary of States Henry Kissinger, Condoleezza Rice and Colin Powell and former UK Prime Minister Tony Blair as well as former World Bank President James Wolfensohn and former U.S. Secretary of the Treasury and Goldman Sachs executive Henry Paulson. Schwarzman has also donated hundreds of millions of dollars to create an AI-focused institute at Oxford University.

Then, in the U.S., Schwarzman gave $350 million to MIT, prompting the school to create the Schwarzman College of Computing, which aims to specifically “address the global opportunities and challenges presented by the ubiquity of computing — across industries and academic disciplines — and by the rise of artificial intelligence.” MIT News later noted that “the impulse behind the founding of the college came from trips he [Schwarzman] had taken to China, where he observed intensified Chinese investment in artificial intelligence, and wanted to make sure the U.S. was also on the leading edge of A.I.”

The college’s inauguration also featured Henry Kissinger as a speaker, where Kissinger mulled the potential impacts of AI and stated that “AI makes it technically possible, easier, to control your population.”

Eric Schmidt, the former CEO of Google, credits Schwarzman’s lead to invest in AI education in the U.S. and abroad as determining “the future of American philanthropy.” “Steve’s donation triggered an arms race among all the universities to match him. This is the next trend in philanthropy, in my view,” Schmidt told Axios regarding Schwarzman’s MIT donation last May. Schmidt also stated that his own investment in Princeton University’s Computer Science department had been prompted by Schwarzman’s previous acts of “AI philanthropy.”

In May of 2019, a federal commission that Schmidt chairs, called the National Security Commission on AI (NSCAI), produced a document that was obtained by a FOIA request earlier this year. One particularly important page made a point that was essentially repeated in Schwarzman’s July Op-Ed regarding a “global AI compact.” Titled “The Importance of a US/China AI Cooperation,” it begins with a quote from Kissinger, a key advisor to and “great friend” of Schmidt, about the need for “arms control negotiation” for AI and then states that “the future of [AI] will be decided at the intersection of private enterprise and policy leaders between China and the US.”

In other words, the Schmidt-chaired NSCAI argues that the future of AI will be determined by the political leaders and business leaders of China and the U.S. The page also adds that “we [The United States] risk being left out of the discussions where norms around AI are set for the rest of our lifetimes. Apple, Amazon, Alibaba, and Microsoft will not be.”

This is particularly significant given the NSCAI is tasked with making recommendations to the federal government regarding how to move forward with AI regulations within the context of “national security” and its members include key members of the Pentagon, U.S. intelligence community and Silicon Valley behemoths that double as contractors to the U.S. military, U.S. intelligence or both.

One of the NSCAI’s interests, per the FOIA-obtained document, is the use of “AI in diplomacy,” suggesting that it also seeks to explore potential State Department uses for AI. Notably, earlier this year, and a year after the aforementioned NSCAI document was written, the State Department saw key aspects of its IT infrastructure privatized and given over to NSCAI-linked companies like Microsoft.

The Establishment Divide Over AI

Given Schwarzman’s views on AI, his AI-focused “philanthropy,” and Blackstone’s recent pivot towards technology, it becomes easier to understand why Blackstone hired David Urban to lobby the Department of Defense and the State Department. Over the last several years, Schwarzman ally Eric Schmidt has “reinvented himself as the prime liaison between Silicon Valley and the national security community” through his chairing of the NSCAI and other positions and has been lobbying “to revamp America’s defense forces with more engineers, more software and more A.I.”

Blackstone’s plans to use David Urban to woo the Pentagon are likely directly related to these efforts to speed up and determine not just when but how the U.S. military adopts A.I-driven technologies, particularly regarding the degree of collaboration with China.

Schwarzman, Schmidt, Kissinger and their allies, as pointed out above, appear to favor direct collaboration with China regarding A.I., seeing it as better for business and the best way to avert “catastrophe.” This is particularly true for Schwarzman who has close business ties to China and has been described as “Trump’s China whisperer” by mainstream media. Indeed, Schwarzman and Blackstone have completed numerous, multi-billion dollar deals in China, with a Hong Kong-based publication even claiming that “Schwarzman has become the go-to man for Chinese buyers.”

In addition, Schwarzman has a strong personal relationship with Chinese leader Xi Jinping and is credited with softening Trump’s rhetoric and stance on certain issues related to China since 2017. Part of the reason for this, per Henry Kissinger, owes to Schwarzman’s “unique standing” in China where Schwarzman has “done so many useful things.”

Despite his close ties to Schwarzman, Trump has sent mixed signals regarding how much of Schwarzman’s advice regarding China he will take. Trump’s tendency, in public anyway, has been to bolster the nationalist rhetoric of the cadre of neoconservatives and other figures who compose the Committee on the Present Danger, China (CPDC), chief among them former Trump strategist Steve Bannon.

Bannon and other CPDC figures have described Schwarzman as a “rival,” with Bannon specifically singling Schwarzman out, asserting that the Blackstone founder threatened to “undo his efforts” at guiding the President towards more nationalist policies popular with his base, such as fighting an “economic war” with China. Bannon’s concerns are also echoed by some hardliners in the Trump administration and the Pentagon who, like Bannon, view China as an existential threat to U.S. hegemony and, therefore, “national security.”

Ultimately, with David Urban’s hire, Schwarzman and Blackstone appear to be taking their efforts to shape AI’s future by lobbying the Pentagon and State Department directly in the event that Trump’s nationalistic tendencies threaten their vision of U.S.-China collaboration in AI in the post-Coronavirus world.

Limiting Withdrawals and Escalating Bank Runs

The $69 billion private Blackstone Real Estate Income Trust (BREIT) imposed withdrawal limits as Wall Street struggled to keep its usurious Ponzi scam afloat back in December 2022.

AMTV’s Christopher Greene covered the story with warnings about how he believes the bank runs have already started and that the nightmare has only just begun.

“Bank runs have officially started in the United States of America,” Greene said. “We’re going to have bank runs; we’re going to have capital controls; we’re going to have restrictions on withdrawals – and this is only the beginning.”

Blackstone, which holds tons and tons of customer funds and debt, is now prohibiting the willful withdrawal of customer funds and monies in their accounts. How is this any different than SBF or FTX?”

BREIT sits under mountains of debt, Greene added, noting that this is part of why it has run out of liquidity. Blackstone COO told CNBC that investors should look at the fund as a “long-term vehicle that’s well positioned for the future” – in other words, do not panic and leave your money there.

It is not as though investors can even get their money out even if they wanted to, though. With those withdrawal limits in place, they are restricted from doing so, which also sent the company’s stock price tumbling.

“They have zero liquidity because, again, the investments that they’re invested in cannot be sold and they’re in mountains of debt,” Greene warned.

Healthcare Fraud

In March 2021, the Blackstone Group made headlines for extracting hundreds of millions of dollars from a health care company accused of fraud and then cashing out further by taking it through an IPO.

Blackstone is a repeat offender when it comes to owning health care companies that have paid out multimillion dollar settlements for allegedly defrauding Medicare and other government health programs. The same Blackstone executive led acquisitions of multiple healthcare that later paid fraud settlements, suggesting significant failures of monitoring or due diligence.

Blackstone’s Apria Healthcare, which rents out at-home ventilators and other medical products, paid its owners a $210 million debt-funded dividend in December, the same month that the company agreed to a $40.5 million to settle allegations of Medicare fraud. The Washington Post reported that the company submitted false medical claims for ventilator rentals worth millions of dollars to the government, even as it eliminated the jobs of respiratory specialists needed to ensure patients were properly using the machines.

According to the Washington Post, a Blackstone spokesman claimed its executives were unaware of the conduct at Apria that led to the False Claims Act settlement:

“Anderson said Blackstone executives were ‘absolutely not’ aware of the conduct described in the complaint as it was occurring.”

Apria is at least the third Blackstone-owned company to settle False Claims Act suits, two of which related to conduct that occurred under Blackstone’s ownership. The acquisition of all three of those companies (Apria, Vanguard Health Systems, and TeamHealth Holdings) was led by Blackstone Senior Managing Director Neil Simpkins.

Simpkins led Blackstone’s acquisition of Apria and has been on Apria’s board since Blackstone acquired the company in 2008. In September 2018, just months after Apria paid a $75 million dividend (in June 2018) and during the period Apria was accused of defrauding Medicare, Simpkins bought a $37 million townhouse in Greenwich Village

Simpkins also led Blackstone’s 2004 acquisition of Vanguard Health Systems, which in 2015 settled False Claims Act allegations with the U.S. Department of Justice (DOJ). The complaint against Vanguard alleged that the company inflated patient bills, billed for services not provided, performed unnecessary tests to fraudulently increase billing, and altered certain data to fraudulently increase billing. Blackstone sold Vanguard Health Systems to Tenet Healthcare in 2013, but the False Claims Act allegations related to actions taken in 2012, while Blackstone owned the company.

Simpkins also led Blackstone’s 2017 acquisition of TeamHealth, a physician practice platform that in 2017 also settled with the DOJ related to Medicare fraud allegations. The alleged fraud occurred at a company TeamHealth acquired prior to Blackstone’s ownership.

In 2019, TeamHealth helped fund a $53.8 million dark money campaign to block federal legislation cracking down on “surprise medical billing” practices in which patients are unexpectedly hit with exorbitant charges, often following visits to emergency rooms.

- https://www.naturalnews.com/2022-12-13-blackstone-limiting-withdrawals-wall-street-bank-runs.html

- https://www.thelastamericanvagabond.com/real-reason-blackstone-courting-pentagon/

- https://pestakeholder.org/news/blackstone-a-repeat-offender-in-health-care-fraud-settlements/

- https://www.rt.com/op-ed/527300-blackstone-asset-stripping-realestate-ripoff/

- https://thebrandhopper.com/2023/07/01/the-unparalleled-influence-of-the-blackstone-group/

- https://www.fastcompany.com/40469864/the-billion-dollar-company-helping-governments-hack-our-phones

- https://winepressnews.com/2024/06/30/bought-paid-for-joe-biden-is-bankrolled-by-blackrock-and-donald-trump-is-bankrolled-by-blackstone/

- Pam Bondi and Kash Patel Are Protecting Elite Pedophiles - February 12, 2026

- Why the Dead Internet Theory Is True - February 11, 2026

- Why Republicans Will Lose the 2026 Midterms - February 8, 2026